Cash Ratio is a type of Liquidity Ratio that determines a company’s capacity to meet its short-term liabilities/debts only with Cash and Cash Equivalent. It measures the extent to which cash and cash equivalents cover …

Saturday, August 1, 2020

Current Ratio is a type of Liquidity Ratio determines a company’s capacity to meet its short-term liabilities/debts. It is a measure of the extent to which current assets cover the current liability of a company. This …

Quick Ratio is a type of Liquidity Ratio that determines a company’s capacity to meet its short-term liabilities/debts with quick/most liquid assets . It is a measure of the extent to which quick assets cover the current …

Capital Gearing Ratio is a kind of solvency ratio that determines the ratio of fixed return capital to ordinary return capital/share capital. $$Capital\quad Gearing\quad Ratio=$$$$\frac { Fixed\quad Interest\quad Funds…

Debt-Equity Ratio is a type of Solvency Ratio that determines the relative contribution of creditors and the shareholders in the company’s funds . Creditors' contribution is termed as Debt whereas Shareholder’s contr…

Debt Service Coverage Ratio is a type of Solvency Ratio that determines a company’s capacity to pay its debt and debt obligations through its operating profit. It is a measure of extent up to which debt and its compone…

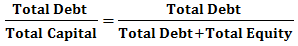

Debt to Capital Ratio is a type of Solvency Ratio that determines the contribution of Debt in a company’s Total Capital. It is a measure of the total debt of a company relative to its total capital. Creditor's contr…