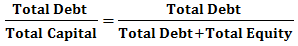

Debt to Capital Ratio is a type of Solvency Ratio that determines the contribution of Debt in a company’s Total Capital. It is a measure of the total debt of a company relative to its total capital. Creditor's contribution is termed as Debt and Debt along with total Equity is termed as Total Capital.

$$Debt\quad to\quad Capital\quad Ratio=\frac { Total\quad Debt }{ Total\quad Capital } $$Total Debt = Long Term Debt + Current or Short-Term Debt; hence, total debt includes all debts/liability payable within a year and payable in the long-term.

Where,

$$Debt\quad to\quad Capital\quad Ratio=\frac { Total\quad Debt }{ Total\quad Capital } $$Total Debt = Long Term Debt + Current or Short-Term Debt; hence, total debt includes all debts/liability payable within a year and payable in the long-term.

Where,

- And Total Capital = Total Equity + Total Debt; total capital implies shareholders as well as creditors contribution.

Significance and Interpretation

- Debt to Capital Ratio =

- For, Debt to Capital Ratio = 1, Total Equity must be Zero, which is not possible.

- Hence, the Maximum Value of Debt Capital Ratio = 1

- Debt Capital Ratio = 0.5: This implies that the Debt Contribute to 50% of the Total Capital or Total Debt is equal to Total Equity i.e. there is just enough Equity to cover all Debt.

- Debt Capital Ratio <0.5: This implies that Debt contributes to less than 50% of the total capital and there is enough equity to cover all debts.

- Debt Capital Ratio > 0.5: This implies that Debt contributes to more than 50% of the total capital, the company faces lots of issues in times when the interest rates rise.

- The ideal Debt Capital Ratio < 0.5, which indicates that the company has less than half of the capital as debt (both current as well as non-current). However, it must be noted that this limit may shift depending upon the regulatory reforms and/or type of business.

- A low Debt to Capital Ratio is beneficial for lenders to the company, wherein a high Debt to Capital Ratio is beneficial to the company for trading in Equities.

Examples

Example 1:

M/S ABC Ltd. reported short term debts worth ₹80 Crores, long term debts worth ₹ 220 Crores and total equity as ₹450 Crores, find the debt capital ratio of M/S ABC Ltd

Solution:

Total Debt = Short Term Debt + Long Term Debt

⇨ (80+220)

⇨ ₹300 Crore

Total Capital = Total Debt + Total Equity

Total Capital = Total Debt + Total Equity

⇨ (300 + 450)

⇨ ₹750 Crore

Hence, Debt Capital Ratio = Total Debt / Total Capital

Hence, Debt Capital Ratio = Total Debt / Total Capital

⇨ 300/750

⇨ 2/5 or 0.4

Example 2:

The following information is available about M/S XYZ Ltd, find debt capital ratio of the firm.| Sr. No | Particulars | Amount (in ₹ Cr) |

|---|---|---|

| 1 | Current Liability | 400.00 |

| 2 | Non-Current liability | 120.00 |

| 3 | Share Capital | 180.00 |

| 4 | Money Reserved Against Share Warrants | 800.00 |

| 5 | Reserves and Surplus | 50.00 |

Solution:

Total Debt = Current Liability + Non- Current Liability

⇨ ₹520Crore

Total Capital = Total Debt + Share Capital + Money Reserved Against Share Warrants + Reserves and Surplus

Total Capital = Total Debt + Share Capital + Money Reserved Against Share Warrants + Reserves and Surplus

⇨ ₹1030 Crore

Debt Capital Ratio = Total Debt / Total Capital

Debt Capital Ratio = Total Debt / Total Capital

⇨ 520/1030

⇨ 52/103

Hence, Debt Capital Ratio = 52/103 or 0.5

Hence, Debt Capital Ratio = 52/103 or 0.5